Projects

Trading Strategy Development Example

Developing a real-world trading strategy based on the insights from our Markov Chain study. The strategy presented is a live trading strategy that I personally use, with only minor parameter differences from my own settings.

View Project

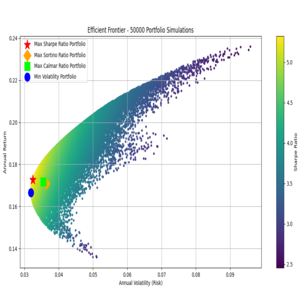

Multi-Criteria Optimal Portfolio Allocation

This project provides a robust Python solution for determining optimal portfolio allocations based on a set of user-defined stock tickers and historical data. Utilizing the Monte Carlo Simulation technique, this tool identifies portfolios that excel across several key risk-adjusted metrics, moving beyond just the traditional Sharpe Ratio to offer a more nuanced view of capital efficiency and risk management.

View Project

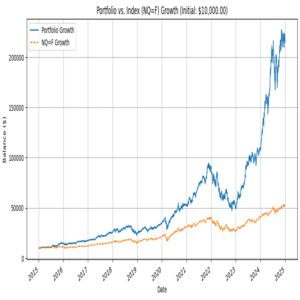

Quantitative Portfolio Performance Simulation and Analysis

This repository hosts a robust Python simulation designed to quantitatively backtest the performance of a custom-defined stock portfolio against a major market index over a specified historical period. The portfolio's asset allocation—defined by the stock tickers and their corresponding weights—is sourced directly from a data-driven Optimal Portfolio Allocation model developed in a prior project.

View Project

200-SMA and 2-RSI Trading Strategy

Python script to implement a backtesting simulation for a simple trading strategy using two common technical indicators: the 200-day Simple Moving Average (SMA) and a 2-period Relative Strength Index (RSI). The strategy is designed to identify and capitalize on potential buy and sell signals based on the confluence of these indicators.

View Project

Portfolio Trading Strategy Backtester

Python script to implement and backtests a multi-asset trading strategy on a portfolio of many different stock tickers. It leverages common technical indicators to generate buy and sell signals and simulates portfolio performance over historical data.

View Project

Improvement to an Existing Strategy

An Example of How to Improve the Existing Trading Strategy in MQL5

View Project

RSI-2 Stock Trading Strategy Pinescript Version

This repository contains a simple, yet robust, Pine Script trading strategy designed for use on TradingView. The strategy combines two popular technical indicators—a long-term Exponential Moving Average (EMA) for trend identification and a short-term Relative Strength Index (RSI) for entry signals—to manage buy and sell positions

View Project

Market Seasonality Chart Generator

Generating "Market Seasonality" Chart for Any Market listed on Yahoo Finance

View Project

Monthly Seasonality Trading Strategy Backtest

Python script designed to backtest a monthly seasonality trading strategy for a given stock or financial instrument. A "monthly seasonality strategy" is a simple trading approach that takes advantage of historical patterns where a security's price tends to perform better during specific months of the year.

View Project

Price Data Downloader and Converter

Download and convert price data from Yahoo Finance into Metatrader 5 daily bar format

View Project

Using Markov Chain to Analyze a Forex Pair

Using markov chain to analyze first insight of a forex pair, index, or any market

View Project

Markov Chain to Determine Market Risk

Demonstration of assessing market volatility risk using Markov Chain

View Project